The Executive’s Guide to Surge Pricing and Dynamic Pricing Models

When we think of surge pricing, we typically think of uber and airlines; however, it can be an untapped profit lever for B2B firms - if done right.

While consumers know surge pricing from hailing a ride on a rainy evening, the underlying principle of demand-based pricing holds immense potential in manufacturing, distribution, and retail.

Too many B2B companies still set prices once a year or stick to cost-plus formulas, assuming that’s “good enough.” In reality, this static pricing trap quietly erodes profit and agility. Consider these symptoms of pricing inertia: missed revenue opportunities when prices stay flat during demand surges, margin erosion from knee-jerk discounting in slow periods, inventory imbalances (excess stock and stockouts) due to inflexible prices, and inconsistent deal-making where sales reps improvise discounts without guardrails.

It’s no surprise that a significant number of mid-market firms remain anchored to outdated models, essentially leaving substantial profit unclaimed every dayIn distribution, for example, a modest 1% uptick in average realized price (after discounts) can translate to an 8–11% boost in operating profit; yet that leverage is often lost by clinging to rigid pricing. Why act now? The stakes are high. External shocks like sudden tariffs or spikes in raw material costs can wreak havoc on margins.

If you can’t adjust prices more frequently than your annual price increases, you either forfeit margin or alienate customers with across-the-board hikes. Surge pricing (in essence, pricing tuned to demand) offers a way out of this dilemma by enabling price changes that reflect current market conditions rather than last quarter’s assumptions. In the sections that follow, we’ll unpack how dynamic pricing works, explore use cases in B2B industries, and outline how Revology’s approach turns your transactional and firmographic data into an actionable pricing strategy.

Unpacking Dynamic Pricing Models

At its core, surge pricing is a form of demand-based pricing where prices temporarily increase during spikes in demand (or conversely, fall in periods of low demand). It’s a subset of the broader family of dynamic pricing models, which adjust prices continually based on real-time data. Ride-share apps and airlines are classic examples: when rider demand outstrips driver supply, Uber’s app multiplies fares to rebalance the market. In fact, one study found Uber’s surge logic doubled the number of drivers on the road after a sold-out concert, ensuring customers eventually got rides.

Airlines pioneered yield management decades ago, leveraging dynamic rates to fill seats and adding an estimated $500 million per year in revenue for American Airlines in the 1980s.

Unlike static pricing, dynamic pricing isn’t a combination of data and gut-feel (or corporate lore), or annual set-and-forget lists. It’s a model-driven approach to finding “the right price at the right time for the right customer.” A dynamic pricing system ingests a myriad of inputs (current demand, inventory levels, competitor prices, time of day, and even weather), and continually recalculates an optimal price. This doesn’t mean prices must change every minute for every product. It means your pricing can adapt as needed, in targeted ways. As BCG observes, many B2B leaders mistakenly equate dynamic pricing with high-frequency price chaos, when in fact it can take many forms and degrees of frequency.

The end goal is price optimization: capturing a higher margin when customers are willing to pay more, and not losing volume when they won’t. According to McKinsey, companies that get dynamic pricing right have seen 4–8% margin upticks and 5%+ revenue growth as a result.

In some cases, they even uncovered products priced so inefficiently that prices could be raised 60% with virtually no volume loss, a dramatic illustration of how static pricing can leave money on the table. Let’s break down a few key dynamic pricing models relevant to B2B:

Peak Pricing: Adjusting prices for predictable demand peaks. Just as electric utilities charge more during peak hours, a B2B supplier might implement peak pricing during seasonal rushes or for expedited orders. The goal is to manage demand spikes and capacity constraints by charging a premium when everyone wants the same product at once. For instance, a chemicals manufacturer with a high market share could introduce a peak-season surcharge on a solvent that every buyer stockpiles in Q4, encouraging some orders to shift earlier or compensating for higher carrying costs. Peak pricing is about monetizing those rush periods instead of suffering stockouts or over-investing in standby capacity.

Yield Management: Born in industries with perishable inventory (think hotel room nights or airline seats), yield management focuses on maximizing revenue from a fixed capacity. In a B2B context, yield management can apply wherever you have a fixed production output or inventory that loses value if unsold. For example, a steel mill producing a set tonnage per week might use yield management to adjust prices based on order backlog and slack capacity—discounting just enough to fill idle slots, but charging a premium when the order book is full. The principle is to sell the right product to the right customer at the right time for the right price. Done well, this can significantly lift revenue. (In the airline world, American Airlines famously estimated yield management added $1.4 billion in profit over three years. B2B firms can similarly see 3–7% revenue gains with dynamic capacity-based pricing, according to industry studies.)

Variable Pricing (Customer-Specific Pricing): Tailoring prices to different customer segments or contexts. Not all customers are created equal—factors like order volume, loyalty, contract terms, or region might merit different pricing. Unlike one-size-fits-all list prices, variable pricing (a structured form of dynamic pricing) allows companies to align price with customer value. For example, a distributor might set higher prices for last-minute “spot” buys than for customers who commit to forecasts, or offer targeted discounts to strategically important accounts. Modern e-commerce has taken this further with personalization (even Amazon practices some price variation based on user data), but in B2B the practice is usually constrained by fairness and transparency considerations. The key is to use data to segment where differentiated pricing makes sense, capturing extra margin from less price-sensitive buyers and markets, while still being competitive where it counts.

Real-Time Market Pricing: In markets with highly volatile input costs or commodity-like products, prices can be linked to real-time indices or triggers. For instance, a building materials supplier might tie prices of lumber or steel products to commodity market benchmarks or freight indexes, updating quotes monthly, or even weekly / daily. This real-time pricing approach ensures cost changes are passed through quickly and consistently. It protects margins when costs rise and can opportunistically drop prices if costs fall (potentially boosting volume). The automation aspect is critical here: with modern tools, companies can program rules like “if raw material X increases 5%, and competitive price indices are within an acceptable range, raise price Y by 3% for new orders,” enforcing discipline and speed beyond human manual updates.

Each of these models falls under the dynamic pricing umbrella. Importantly, implementing them is not about price gouging or alienating customers. When executed with a customer-centric mindset, dynamic pricing can actually enhance fairness: customers who value urgency or guaranteed supply pay more, while price-sensitive customers can opt for off-peak or slower options at a lower price.

When dynamic pricing goes wrong (and what B2B can learn)

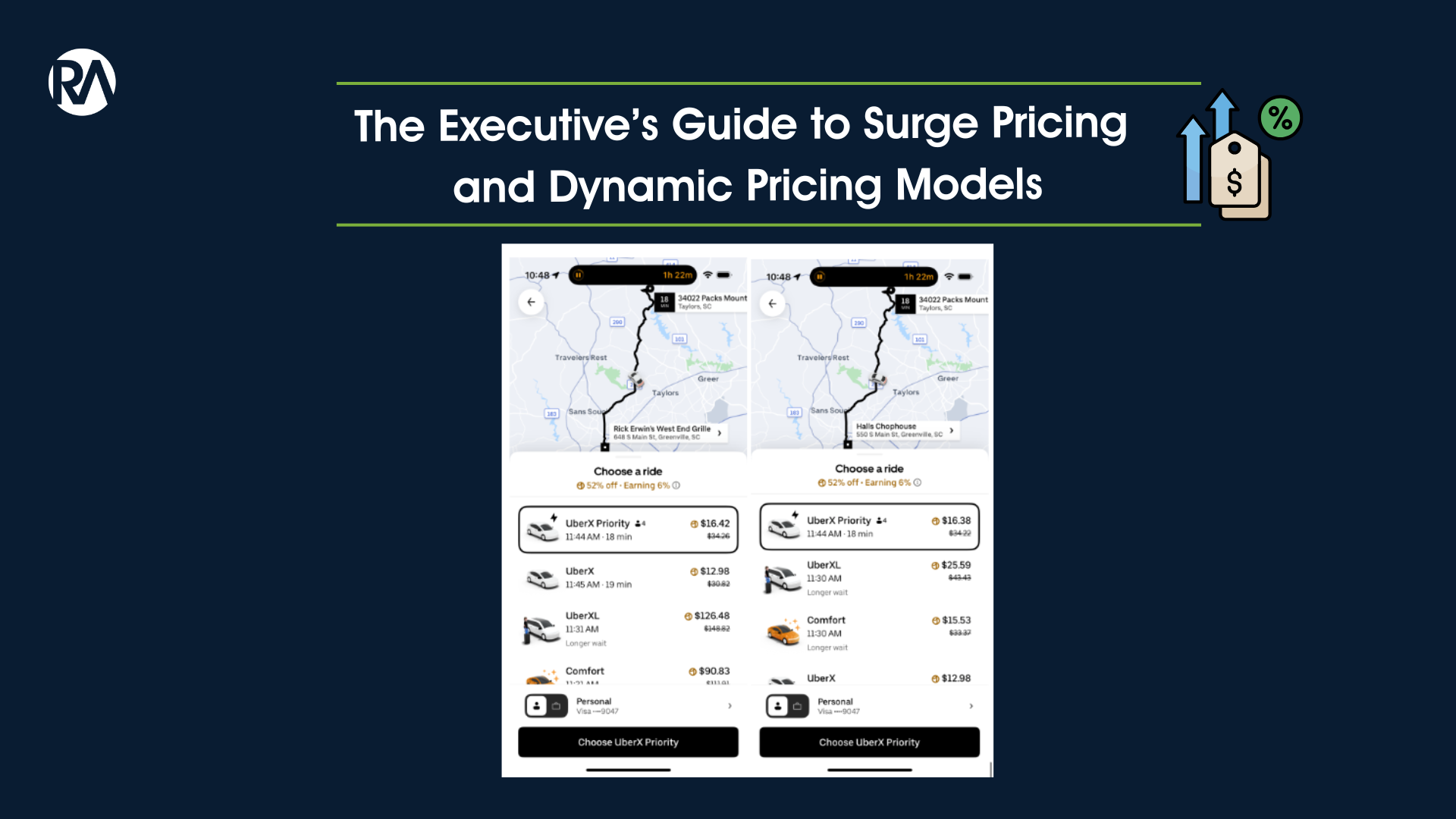

During a recent evening out in downtown Greenville, six of us tried to book an UberXL to Rick Erwin’s West End Grille. The app showed $126 for UberXL. Out of curiosity we typed a different destination, Halls Chophouse, a one‑minute walk from Rick Erwin’s, and saw $26 for the same UberXL, same pickup point, same time. A $100+ difference with no apparent change in traffic or route.

A $126 Uber XL ride to Rick Erwin’s West End Grille, but a $26 one to Hall’s Chophouse. We rode to Hall’s Chophouse, walked 1 minute to Rick Erwin’s, and saved $100 in the process.

What might explain the gap? A few hypotheses informed by how ride‑share pricing actually works:

Micro‑geofenced surge zones. Uber divides cities into discrete surge areas. Crossing a boundary, even by a block, can put your drop‑off into a zone with a different multiplier. That can create sharp price cliffs between nearby destinations.

Route‑level demand patterns in upfront pricing. Uber’s upfront fares incorporate the origin and destination pair, time, estimated duration, and “demand patterns for that route at that time.” If the model predicts lower driver acceptance or tougher post‑trip repositioning for one destination vs. another, it can charge more to ensure the job is attractive to a driver. However, this clearly wasn’t the case for us.

Pin accuracy and venue metadata. Minor differences in map pins (e.g., garage vs. curb, event entrance vs. general drop-off) can alter the time, distance, or fees that the system expects for driver fulfillment. Uber’s own guidance notes that incorrect pickup/drop‑off can lead to very different fares. Again, this was not the reality for us (both restaurants on the same street, just one small block away).

The lesson applies well beyond ride‑share. Dynamic pricing requires clear rules, tight data, and guardrails. When models are opaque or zones are too coarse, you get price cliffs that feel arbitrary. In B2B, avoid “Rick‑vs‑Halls” moments by (i) defining pricing corridors that cap near‑neighbor gaps, (ii) testing geographies for unintended cliffs, and (iii) making exception logic transparent to sales and key customers. The other lesson is, of course, that Pricing people will always take advantage of dynamic pricing!

Dynamic Pricing for Manufacturing, Distribution, and Retail

Adopting dynamic pricing doesn’t mean throwing darts at a board. It means using data and business logic to adjust prices in a way that makes economic sense. Let’s explore how mid-market companies in three sectors (manufacturing, distribution, and retail) can deploy dynamic pricing strategies for tangible gains:

Manufacturing:

Manufacturers often face fluctuating raw material costs and batch production schedules. Dynamic pricing can help them protect margins and balance demand.

Use case: A specialty parts manufacturer experiences periodic surges in orders for a particular component whenever a major OEM has a production ramp-up. Instead of first-come, first-served at old prices (and then scrambling with overtime costs), the manufacturer introduces surge pricing for rush orders on that component. During peak demand weeks, they add a 10% premium for expedited production slots. This not only secures an extra margin to cover overtime and stress on the line, but it also subtly rations demand; customers with urgent needs still buy (and pay for priority), while others delay purchases or accept standard lead times. The manufacturer also ties pricing to input costs: if copper prices shoot up 15% this quarter, they apply a formula-based increase on copper-heavy products rather than waiting a full year to adjust. The payoff? Higher profitability with controlled volume impact. In one real-world example, a U.S. aviation parts maker used predictive analytics to spot an early spike in demand for certain spares and adjusted prices accordingly, netting a 12% revenue boost on those lines in a single quarter

That kind of agility not only pads margins but also signals to the market that pricing is actively managed, discouraging opportunistic bulk buys or gray-market arbitrage when prices are static.

Distribution:

Distributors operate on razor-thin margins and deal with constant cost volatility (fuel, freight, supplier price changes) and uneven regional demand. For them, real-time pricing can be a game-changer to avoid profit leakage.

Use case: A chemicals distributor serving multiple regions sets up a dynamic pricing system that updates quote guidance daily based on inventory levels and local demand. If inventory of a solvent is piling up in the Midwest branch, the system might auto-discount those SKUs for that region to clear stock (preventing costly obsolescence). Conversely, if a hurricane disrupts supply on the Gulf Coast, the distributor can instantly raise prices for affected products in nearby markets to reflect scarcity (capturing value on limited stock). They also employ yield management logic for truckload deliveries: lanes or times of week with limited trucking capacity carry a higher delivery surcharge during crunch periods, nudging customers to opt for flexible delivery windows. The distributor’s sales reps are supported with an AI-driven quoting tool that scores each deal. One such company found that by introducing dynamic price recommendations in the quoting process (via a tablet app), it cut deal processing time from several weeks to just a day or two, speeding up sales and improving customer satisfaction.

Perhaps most importantly, dynamic pricing with guardrails reduces the wild west of ad-hoc discounts. Reps have data-backed target prices and walk-away floors based on similar deals, so they discount more consistently and profitably. The outcome: margin improvement on everyday transactions. Indeed, distributors leveraging data-driven pricing have achieved margin lifts on the order of 2–4 percentage points, which for a business with 15% gross margin can mean a 10–20% boost in profitability.

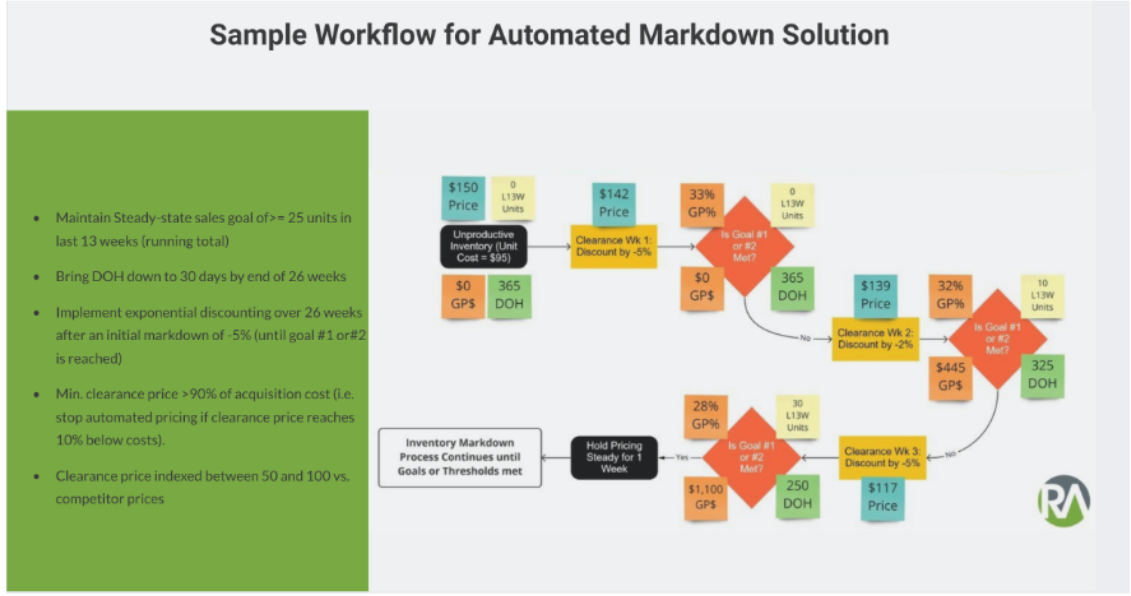

An example of a simple dynamic markdown optimization capability for a distributor. For most mid-market distributors, an intelligent, rule-based automated pricing system is more than enough to start their “dynamic pricing” journey.

Retail (and E-Commerce):

Retailers, including those selling B2B2C or direct-to-consumer, have been early adopters of dynamic pricing online. But even brick-and-mortar retailers can benefit from variable pricing strategies.

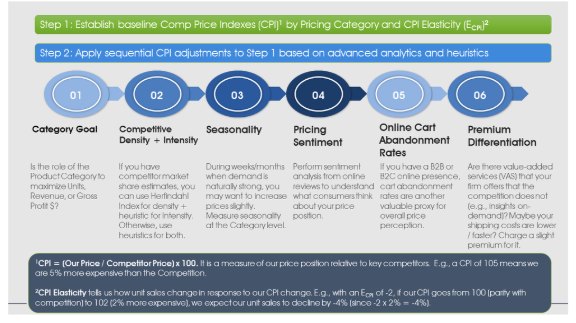

Sample framework for elasticity and rule-based dynamic pricing in Retail.

Use case: A regional appliance retailer uses a dynamic pricing engine to adjust prices for its online store daily, based not only on competitor prices but also on stock levels and seasonality. High inventory of last year’s refrigerator model? The algorithm drops the price gradually (and flags it for a clearance promotion) to ensure sell-through before new models arrive. For in-demand items—say a new gaming console during holiday season—the system might raise prices slightly if the local market is selling out, capturing extra margin on each unit (within reason, to avoid customer backlash). Real-time competitor scraping means if a major competitor runs a flash sale, the retailer’s prices can respond within hours to stay in the game. In-store, dynamic pricing might take the form of electronic shelf labels that update prices overnight for tomorrow’s sales or by time of day (think happy hour pricing in convenience stores, or end-of-day discounts for perishables). For instance, supermarkets already mark down bakery items in the evening; digital pricing can make such adjustments more precise and automated. A famous example in e-commerce: Amazon reportedly changes prices 2.5 million times a day, updating product prices about 50 times more often than Walmart on average. The result is that Amazon consistently optimizes for demand and inventory turns, which has significantly boosted its profits.

A helpful way for Retailers to think about Product segmentation for their dynamic pricing efforts is to segment their products based on Size (Net Sales), Assortment (pct of SKUs) and Competitive Price Elasticity (how responsive is demand to changes in relative price positioning).

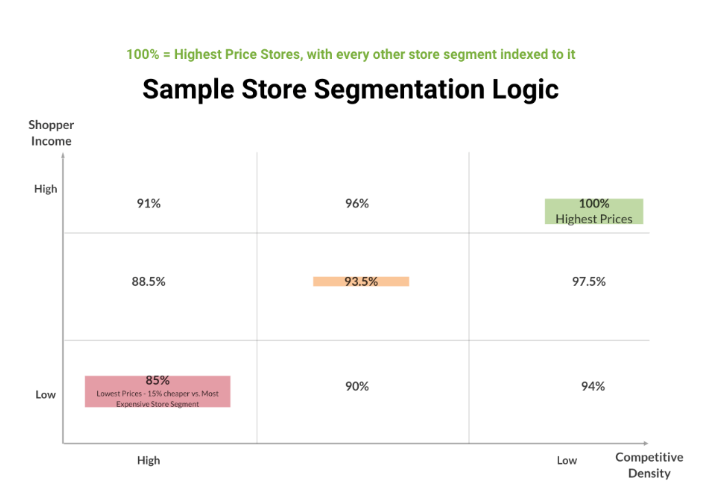

Sample store segmentation logic for Dynamic Pricing. Stores with the lowest competitive density and highest income levels (you can use store lease expense as a proxy) will have the highest markups vs. stores with the highest competitive density and lowest income.

Mid-market retailers won’t operate at Amazon’s scale, but they can adopt the same principle on a targeted set of products, especially seasonal goods, high-margin accessories, or items prone to stockouts or overstocks. The bottom line for retail: dynamic pricing can increase sell-through and gross margin simultaneously. Retailers who intelligently segment their stores and product assortment and apply either price optimization or some rule-based dynamic pricing often see a 2–5% overall revenue uptick and higher inventory efficiency.

Across these examples, one theme stands out: dynamic pricing is part science, part strategy. It’s not about random price swings; it’s about using better information to make more nuanced pricing moves. Of course, implementing this in a B2B environment raises practical questions: How do we avoid alienating customers used to stable pricing? What if sales reps push back? How do we integrate this with our ERP systems? That’s where a structured approach and expert guidance become critical.

Implementing a dynamic pricing strategy requires moving beyond annual price lists and gut-feel decisions, as outlined in the examples above. The next step is to translate these concepts into a practical, AI/ML-driven system using your data.

Revology Analytics helps organizations develop this capability internally, typically in 3-4 months, relying on your existing technology stack. Our focus is on building a sustainable, lasting capability that substantially enhances your current pricing practices and aligns with your specific market conditions. Learn how we can help transform your data into a sustainable pricing strategy for long-term growth.

Stay tuned for part 2 on Surge Pricing and Dynamic Pricing next week.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.