Solving Unproductive Inventory Challenge with Dynamic Markdown Pricing - Case Study

SITUATION

A leading North American consumer durables distributor faced significant liquidity issues due to unproductive inventory resulting from aggressive buying habits.

About 15% of their on-hand inventory was either discontinued or inactive, and their existing Oracle-based pricing system was inadequate for managing clearance pricing.The distributor, generating $5B in revenue, struggled with a substantial portion of its inventory needing to be more productive. Aggressive buying habits led to approximately 15% of on-hand quantities being discontinued or inactive, tying up significant liquidity. This unproductive inventory posed a major challenge as the existing Oracle-based pricing system was not designed for effective clearance price management.

-

Upgrading the pricing system would be costly and time-consuming. The company lacked an analytical approach to managing and pricing unproductive inventory, putting additional strain on its financial health.

With a substantial amount of capital tied up in unsellable goods, the company needed a strategic solution to mitigate these issues and free up liquidity.

A sample workflow for an automated Pricing Markdown solution

ACTION

Revology Analytics partnered with the company to develop a Clearance Strategy and implement an automated Markdown Price Optimization solution, resulting in a nationwide rollout.

Revology Analytics engaged in a comprehensive four-month process to address the company’s unproductive inventory challenge. Initially, we defined the problem, quantified the opportunity, and formed a cross-functional team comprising members from Pricing, Finance, Supply Chain, and IT.

This team broke down the problem into sub-components and identified critical data elements needed for a dynamic clearance pricing solution.

-

We designed and developed an automated Markdown Price Optimization solution, including a six-week A/B price test in four markets.

The solution was tailored to automate the markdown process while maintaining a minimum clearance price above 90% of the acquisition cost, ensuring profitability.We conducted stakeholder sessions and executive roadshows to ensure alignment, gather feedback, and refine the solution. After the pilot’s success, we rolled out the automated Clearance Markdown Solution nationwide across 120 Distribution Centers. This rollout included providing a detailed Clearance Pricing architecture, cross-training an internal Data Scientist, and creating a transparent Clearance Pricing Guideline for the Sales team.

Markdown performance measurement dashboard built in Tableau

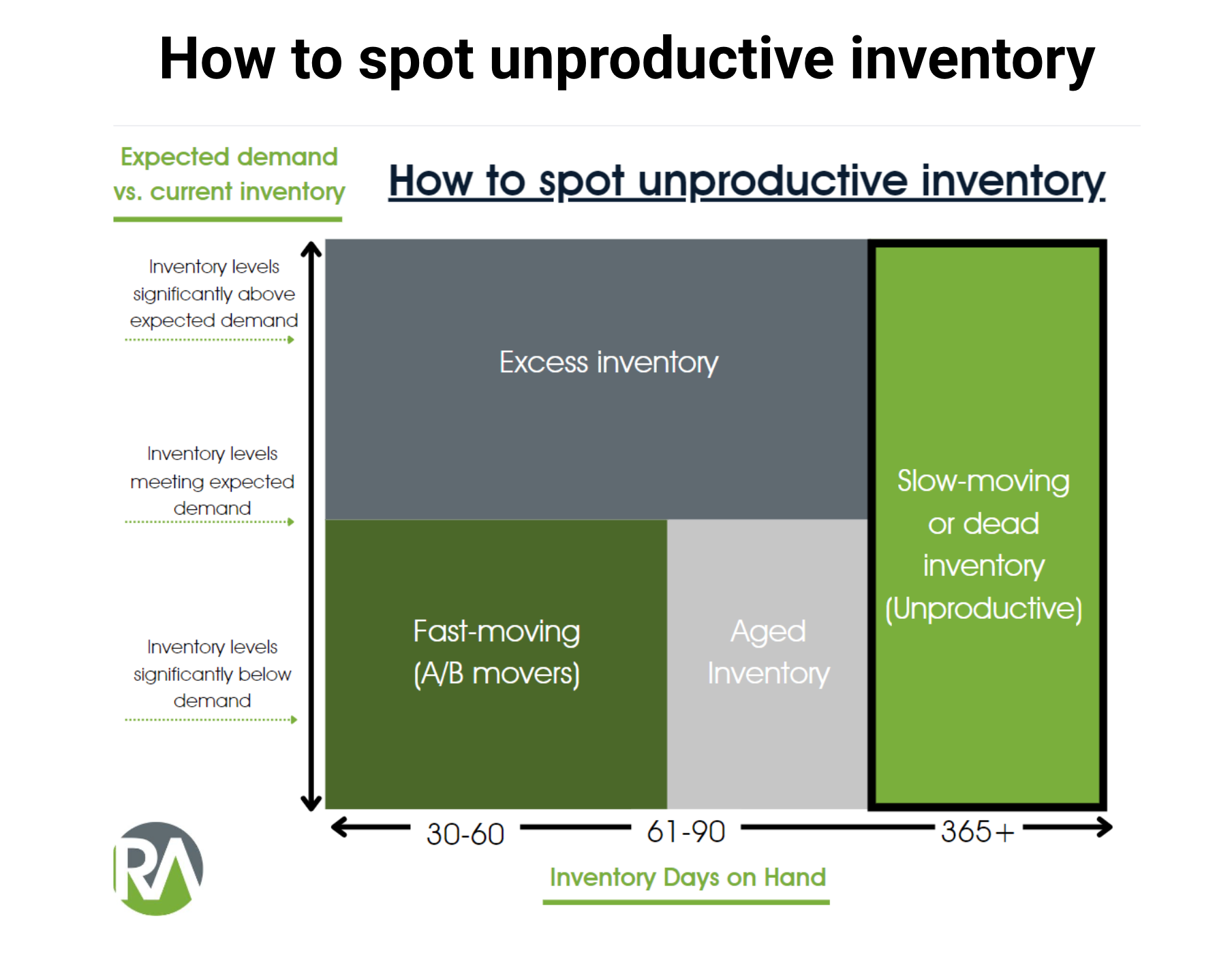

How to spot unproductive inventory

OBSTACLES

The company faced a forecasted EBITDA shortfall due to $150 million in unproductive inventory.

The absence of a clearance pricing process caused friction with Customer Development Managers (CDMs) and logistical challenges at Distribution Centers.One of the critical obstacles was the forecasted EBITDA shortfall resulting from $150 million tied up in unproductive inventory. This dormant inventory negatively impacted the company’s liquidity and borrowing base, as banks were unwilling to lend against obsolete or dormant inventory. This financial strain necessitated immediate action to reclaim tied-up capital.

The absence of a structured clearance pricing process caused significant friction between the company’s Customer Development Managers (CDMs) and their customers.

-

The lack of clarity and consistency in pricing led to conflicts and inefficiencies in customer interactions.

Additionally, the Distribution Centers (DCs) were burdened with space issues and wasteful labor costs due to accumulating unproductive inventory. Previous attempts to resolve this issue through manual discounting led to lost profits or further inventory pile-up, demonstrating the need for a more systematic and practical approach.

Bespoke solution built using popular technologies

RESULTS

The Markdown Optimization Solution improved inventory liquidity by 30%, increased Gross Profit by 5% annually, and saved significant labor hours for the pricing and sales teams.

Implementing the Markdown Optimization Solution gave the company a systematic approach to managing its $150 million unproductive inventory problem. The solution improved inventory liquidity by 30%, freeing up capital and enhancing the company’s financial flexibility.

Additionally, the company experienced a 5% annual increase in Gross Profit, demonstrating the financial efficacy of the dynamic markdown strategy. The automated solution saved over 80 weekly work hours for six Pricing Analysts and Managers, allowing them to focus on more strategic tasks.

-

The solution also eliminated hundreds of hours spent by the 200-member sales team on price negotiations with customers.

This reduction in manual effort improved operational efficiency and enhanced employee productivity and satisfaction.

Furthermore, the Finance and Executive team benefited from more accurate forecasting of inventory and cash flows, improving their ability to engage in meaningful conversations with the Board and generate investor goodwill.

The successful deployment of the Markdown Optimization Solution positioned the company for continued growth and financial stability.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.