Mastering Price Elasticity Modeling: Best Practices for 2024

Are you struggling to find the pricing sweet spot that boosts profits while staying competitive in a crowded market? Setting the right price for your products or services is tricky. Determining price is amongst the most challenging things a commercial strategist must do when working on pricing strategy, in large part because it has such a massive effect on the company’s bottom line or profitability. One of the crucial aspects of pricing is understanding what Pricing / Revenue Growth Management practitioners, financial experts, and economists call price elasticity.

A McKinsey report revealed that, on average, a 1% price increase translates into an 8.7% jump in operating profits for US firms - assuming no volume loss. This shows how important it is to get this right. Mid-market firms relying solely on outdated methods or intuition to set prices risk losing serious ground to competitors.

There’s a simple reason for that. Traditional pricing strategies, including cost-plus or competitor-based pricing, often don't consider the intricate relationship between customer behavior and price and tend to fall short in today's market.

Price modeling techniques have advanced greatly over the past two decades, with many open-sourced resources, and price elasticity modeling offers a more sophisticated and nuanced approach.

Understanding Price Elasticity

In most markets, a large portion of customers are sensitive to the price of a service or a product—to varying degrees, depending on industry and customer segment. The main assumption is that more individuals will purchase the product if it is more affordable (and/or they will buy in more quantities), and fewer will buy it if it is pricier.

Price elasticity demonstrates exactly how responsive or sensitive customer demand is for a specific product or service based on its price. It is one of the most significant and foundational pricing concepts.

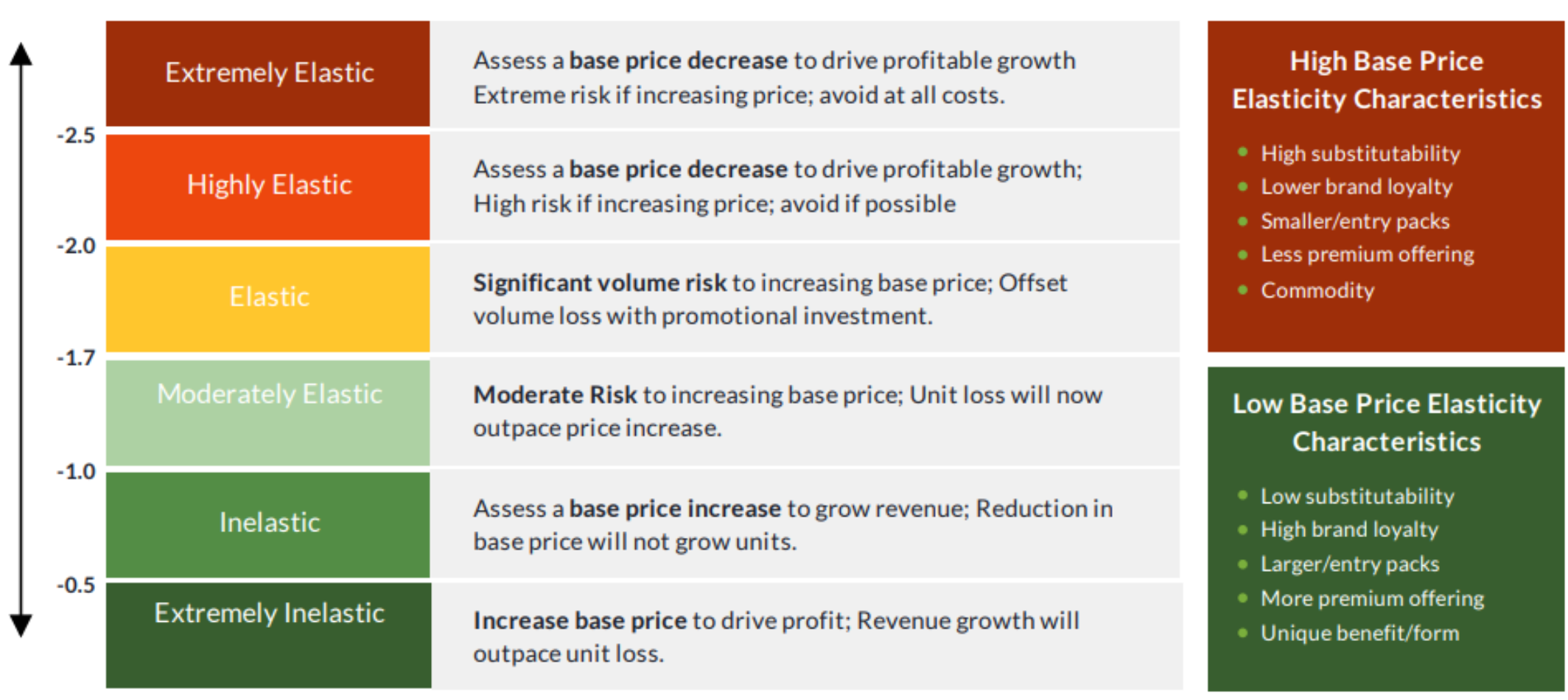

Regular (base) price elasticity and strategic implications

Price elasticity is a numerical value that indicates the percentage change in quantity demanded because of a 1% change in price.

Inelastic Demand (Elasticity < 1): If a product has inelastic demand, even significant price changes are likely to have a minimal impact on demand. Some examples of products that behave this way are essential (or need-based) goods, such as insulin or tires.

Elastic Demand (Elasticity > 1): Small price changes can significantly impact demand. Beef is a good example of a product that is pretty elastic because you can easily substitute pork or chicken. Other examples include luxury goods and non-essential items, like designer clothing and perfumes.

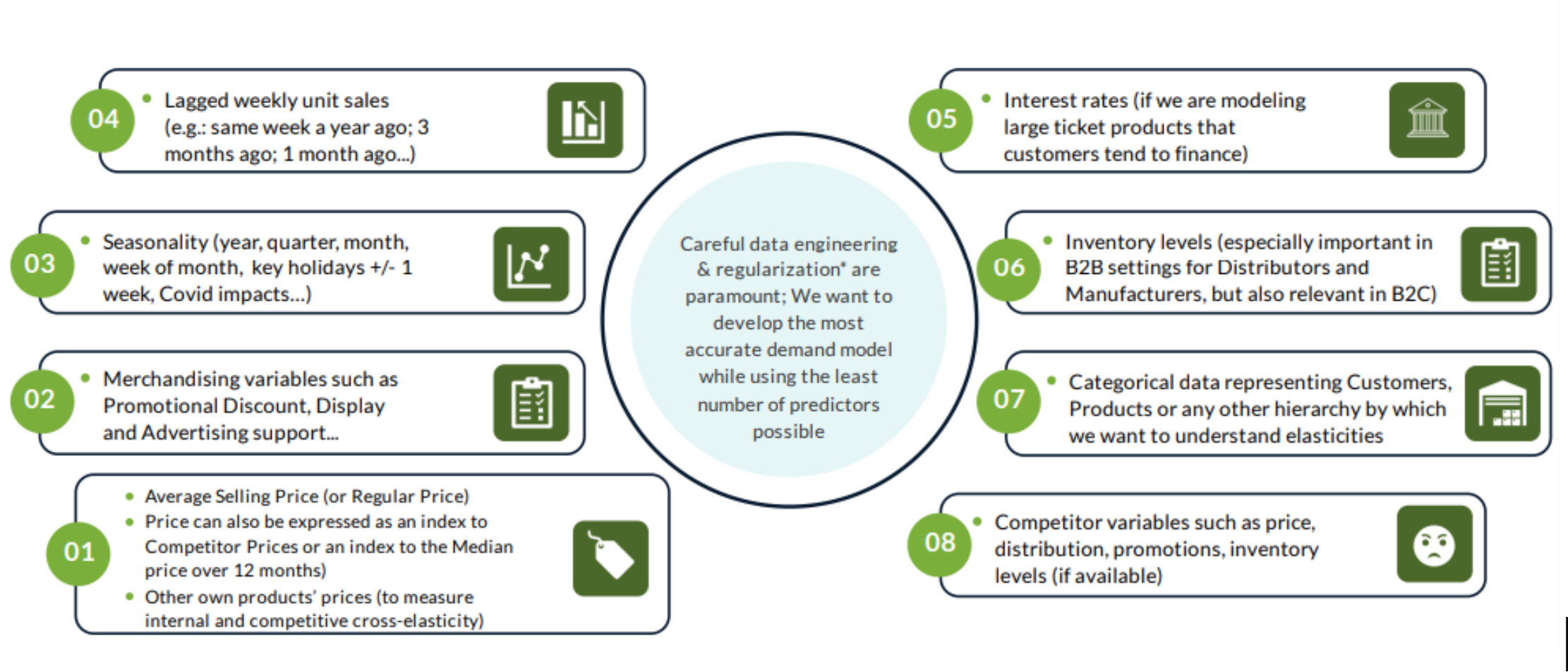

Typical variables used in price elasticity modeling

Significance Of Price Elasticity

While the precise numerical value of price elasticity may not be that important, you must understand where your product or service falls on the spectrum of customer responsiveness to price changes and what will happen to customer demand if you change your price.

Maximize Revenue

If you know how elastic or inelastic the demand for your product is, you can make more informed pricing decisions to maximize overall revenue and profit.

Let’s say a company sells a luxury watch (something similar to a Rolex) with elastic demand. The company may prioritize maximizing profit per unit sold, even if it sells fewer units at a higher price point.

Inform Product Development

So, how can price elasticity inform product development decisions?

If you realize after thorough analysis that your product has inelastic demand, it may indicate a loyal customer base. In other words, people are willing to pay a premium. In these cases, investing in further product development or brand differentiation makes sense.

Traditional vs. Modern Price Elasticity Models

Businesses and companies have for decades relied on two primary pricing models:

Cost-Plus Pricing: Here, you add a markup percentage to the total cost of production to determine a selling price for your product. While cost-plus pricing is simple, it rarely reflects market demand or customer behavior.

Competitor-Based Pricing: Have you ever launched a new product and wondered, "How much should we charge for this gem?" Competitor-based pricing aligns your prices with competitors, making it safe and familiar. This is because you analyze what your top competitors charge and set your price accordingly. While this conventional pricing strategy can help maintain market share, it fails to capitalize on unique product features, differential value, or potential for higher pricing.

Introduction to Price Elasticity Modeling - Understanding Customer Response

Price elasticity modeling is a foundational concept that informs and guides effective pricing strategies. It's an economic and mathematical model that focuses on understanding how demand reacts to changes in price.

Price elasticity modeling is not a standalone strategy; it goes beyond basic pricing strategies like cost-plus or competitor-based and analyzes how customers react to price changes. The data and insights gleaned from price elasticity modeling guide traditional pricing strategies.

While it doesn't determine the final price, price elasticity modeling offers insights into devising smarter pricing strategies to boost revenue and win market share.

Key Distinction - Foundations vs. Strategies

Pricing models are the "how" - the tactics you can use to set or determine a final price point (e.g., cost-plus markup is one way to price the products you distribute).

Consider price elasticity modeling the "why" - you receive data-driven insights into customer behavior to inform and guide your pricing strategy.

Price Elasticity - Not a One-Size-Fits-All Solution

Price elasticity modeling doesn't determine or dictate the final price. Let’s say you offer luxury cruises with unmatched service and exotic destinations, topping it off with world-class amenities. Price elasticity modeling will reveal that your target audience is highly sensitive to price changes. This simply means that even minor price hikes could considerably lower the number of bookings.

This data may suggest a pricing strategy prioritizing higher profit margins with slightly fewer sales. However, you would be better off considering this with other variables like brand positioning before making a final decision. Let’s examine brand positioning to understand why price elasticity modeling alone wouldn't determine the final price.

People often associate luxury travel with exclusivity and prestige. Here’s why a significant price drop will not likely work: it could cheapen or adversely affect the brand image.

Price Elasticity - Improving Pricing Strategies

Price elasticity modeling has not been left behind in the age of AI and big data. Modern techniques and practices like dynamic pricing excel as they offer a real-time, insights-driven and nuanced approach that accounts for changing customer preferences and market dynamics. As a result, you can benefit from more accurate and effective pricing strategies.

Here are some advantages of adopting modern price elasticity modeling techniques:

You can make data-driven pricing decisions that optimize revenue. It is easier to calculate the profit-maximizing prices for each specific segment and optimize your prices to serve different goals.

When you can analyze real-time data, making swift adjustments to pricing strategies is a breeze. Modern price modeling techniques help you respond to market changes.

Tailor strategies for different customer segments with varying price sensitivities.

The Evolution of Pricing

It would not be remiss to say that the shift from conventional to modern price elasticity models reflects a broader pricing evolution.

Gut instinct and static models don’t cut it anymore, and you must adopt machine learning-driven, dynamic approaches that maximize profitability and ensure your business stays ahead of the curve.

The Early Days of Linear Models

Traditional price elasticity models tend to employ linear regression. This relatively simple technique analyzes the price and demand relationship using straight lines. However, this oversimplification is one of the pitfalls.

These models undoubtedly provided a fundamental understanding of price sensitivity. In other words, they are a good starting point. However, they are not sophisticated enough to capture and account for the complexities and nuances of real-world customer behavior.

The Rise of Machine Learning - Making the Most of Big Data

Machine learning has helped improve and fine-tune price elasticity modeling. You can use these advanced techniques to analyze vast amounts of data, such as:

Historical sales figures

Customer demographics

Competitor pricing

Social media sentiment

Customer service interactions

Advanced Techniques and Their Benefits

For example, ensemble models merge the power of multiple ML algorithms. Random Forest or Gradient Boosting Machines are two examples that capitalize on the strengths of different approaches to deliver substantially more accurate predictions and price elasticities than regression approaches.

Ranking of price elasticity models by industry

Double Machine Learning

Double Machine Learning (DML) stands out as a robust and sophisticated approach to estimate causal effects, particularly the impact of price on demand, by effectively mitigating the influence of confounding variables. Traditional regression models often struggle to isolate the causal effect of price on demand due to confounding factors like seasonality, competitor activities, or product promotions.

DML is based on a two-step approach:

Prediction: DML utilizes machine learning algorithms like Random Forest or GBM to predict both the outcome variable (e.g., demand) and the treatment variable (e.g., price) based on potential confounders. This step effectively removes the influence of confounders from both variables.

Estimation: After controlling for confounders in the prediction step, DML performs a linear regression analysis on the residuals (differences between predicted and actual values) of the outcome and treatment variables. This residual-on-residual regression isolates the causal effect of price on demand.

Benefits of DML:

Confounder Control: DML effectively accounts for the impact of confounding variables, leading to unbiased estimations of the causal effect of price on demand.

Non-Linear Relationships: By utilizing machine learning, DML can capture non-linear relationships between variables, providing more accurate elasticity estimations compared to linear regression models.

High-Dimensional Data: DML excels in handling datasets with many variables, making it suitable for complex pricing scenarios with numerous factors influencing demand.

Advanced Modeling Techniques

As we have seen, conventional price elasticity methods usually lack the flexibility to adapt rapidly to customer preferences and market changes.

You need price optimization with AI and machine learning to get granular insights. Machine learning-driven pricing offers an advanced approach to price optimization that accounts for many variables that traditional techniques may miss.

Machine Learning and AI

These powerful tools are adept at analyzing vast amounts of data, like purchase history, seasonal buying and changing consumer sentiment. This is a great way for business enterprises to uncover complex relationships and patterns between price and demand and automatically set optimal prices for your products or services.

ML models analyze the variables influencing pricing, including seasonality and competitor prices, allowing for more precise elasticity calculations that capture the true impact of price changes on demand.

The best thing about AI and machine learning algorithms is that they can process and analyze copious amounts of data at an unprecedented speed and scale. This way, you can adjust your pricing to meet specific business goals, like maximizing profits while maintaining reasonable prices for your customers and driving positive price perception.

To further refine pricing strategies, businesses are increasingly turning to revenue management consulting to leverage expertise in price sensitivity analysis and develop tailored, dynamic pricing models.

Big Data Integration

Modern models can gobble up real-time data from various sources - social media, market research, and customer reviews. If you run a travel agency that caters to discerning clients, you can analyze customer reviews on travel websites, like Airbnb and Expedia Group, to understand customer satisfaction and preferences. Receive a more comprehensive view of customer behavior, trends, and market dynamics to inform your decision-making.

Predictive Pricing

Rational pricing often relies on data, and it should. Given the large amounts of data available, traditional solutions and approaches will no longer be adequate. Predictive pricing using AI and ML allows organizations to anticipate changes in demand and adjust prices accordingly.

Let’s assume you are an online retailer that sells athletic apparel for sports enthusiasts. If you followed the traditional approach, you may set a fixed price for a new line of running shoes, perhaps based on production costs, and then you discount it based on a pre-determine schedule markdown schedule.

However, if you use predictive pricing with AI, you can benefit from an AI model that analyzes historical sales data, weather forecasts, and customer demographics. This underscores the need for AI in price modeling.

Consider one aspect—weather integration. The AI model can incorporate weather forecasts. So, if an unexpected heat wave is imminent in your region, the model may recommend a temporary price cut to encourage purchases of breathable running shoes.

These advanced price elasticity models empower businesses to predict demand fluctuations and make proactive pricing decisions.

Data Collection and Preparation

High-quality data is like the building block of accurate price elasticity modeling, and data preparation is imperative to avoid potential pitfalls. Data quality matters, and your models won’t deliver reliable insights if quality is compromised.

Price elasticity data provides invaluable insights for strategic decision-making, and it can be used to optimize markup percentages and discounts.

Here are some ways to ensure your data powers and informs your pricing strategy:

Collect relevant historical sales data (including price points and quantities sold), competitor pricing information, and customer demographics. Knowing how seasonal trends affect demand is a plus.

Relevancy is not enough. Identify and eliminate any errors, discrepancies, inconsistencies, or missing values. You may also have to standardize units of measurement and fill in missing data points using appropriate techniques.

Integrating data from external sources, such as social media sentiment analysis, is a great way to get a well-rounded and comprehensive view of your customers and market dynamics.

Don’t overlook organization. Structure your data in a format your preferred modeling tool can easily understand.

Practical Applications and Case Studies - Pricing Success Stories

You have seen how advanced modeling techniques work; now, let's see how business pricing models can get you actual results.

In the following section, we will look at the implementation of pricing strategies and practical applications of price elasticity modeling with real-world examples and case studies.

Price Elasticity Real-World Examples

Dynamic Pricing in Ride-Sharing

Dynamic pricing algorithms and price adjustments are undoubtedly responsible for Uber and Lyft’s market success. These ride-sharing companies leverage AI-powered dynamic pricing models to adjust prices in real time. Some factors that affect pricing decisions are supply, demand, traffic patterns, and events.

Personalized Pricing in Ecommerce

Online retailers like Walmart and Amazon use AI and ML to analyze customer data, including browsing history and purchase behavior. Let’s say you browse various women's perfumes on Amazon’s website, getting a whiff of digital floral and citrus notes through your screen.

Here’s what’s happening in the background while you are busy browsing. AI models analyze your browsing history and preferences. They may peek at your past purchases, noting the fragrance categories (soapy, floral, woodsy, fruity, or green) and price points you gravitated toward. Sometimes, they even factor in your age and location.

Based on this comprehensive data analysis, you might be identified as someone who has a penchant for fresh, floral scents at mid-range price points. This puts you in a specific customer segment.

What is the Future of Price Modeling? Future Trends in Price Elasticity Modeling

Price elasticity modeling will only improve from here. Emerging trends like integration with IoT and wearables and explainable AI are shaping pricing strategies. Here's a glimpse of what's on the horizon:

Hyper-Personalization

Customer segmentation will get more granular based on real-time data analysis. Relying solely on demographics - well, those days are long gone. Tomorrow's models will be so good that you may think they are reading your mind.

For instance, you may be browsing for a new pair of athletic shoes on a bright and sunny Saturday morning. The AI model will work and analyze your browsing history (showing past interest in running shoes). It may track your current location (near a park) to infer you're motivated to hit the pavement.

Micro-Moments and Contextual Pricing

Price elasticity innovations and models will increasingly incorporate real-time context to suggest better options. Pricing adjustments based on weather conditions? Yeah, that’s not a far-fetched dream. Why not charge higher prices for ice cream during a heatwave?

Final Thoughts

Savvy business executives don’t leave money on the table with outdated pricing methods that don’t account for market dynamics. It is time to give up guesswork and gut instincts and set prices based on real customer behavior.

Adopt price modeling based on AI and ML to make data-driven decisions that predict demand fluctuations and maximize revenue. This isn't science fiction from a futuristic movie; it's the tipping point. Adopt the latest AI-powered pricing techniques and price elasticity models to leave your competitors in the dust.

Contact Revology Analytics now to learn how we can help you take advantage of the latest pricing techniques and models.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.